Verde Agritech is leading a biofertilizer revolution

This may sound sensationalist, but I believe there a case to be made. A case that may not only be interesting for growth/tech investors, but also for traditional value investors and environmentalists.

Everything should be made as simple as possible but not simpler - Albert Einstein.

Highlights

In this post, I will introduce Verde Agritech, a company with the following characteristics:

It has a sustainable and organic but cost-effective alternative for conventional fertilizers.

The company is profitable, with a P/E ratio around 10, assuming their historically conservative guidance is met.

While their sales prices are likely to drop in the next years, sales volumes are growing dramatically.

Capacity expansion requires little Capex and can be modular.

They recently announced the ability to mix micro-organisms with their fertilizers, opening a powerful new way to support plants with biofertilizers (see the “Verde 2.0” section).

Management has done an excellent job in building this company, is well aligned with shareholders and includes a Nobel Peace Prize Candidate.

Feel free to subscribe here, I would really appreciate it, and and as always thank you for reading.

Share structure

#shares outstanding: ~52,2 M

#options outstanding: <1M

current share price: 8.71 CAD

undiluted market cap (@8.71 /share): ~455M CAD

Net cash/debt: small compared to the market cap

Soil fertilization, soil health and it’s massive implications

There is a big problem with chemical fertilizers that is impacting long-term soil health, food quality, and even the CO2 levels in the atmosphere. Microbes play a key role in this, and Verde Agritech has a powerful (and cost-effective) solution in my opinion.

But let’s first take a quick look at the (conventional) industry. Since the 20th century chemical fertilizers are used to supply nutrients to plants (besides natural fertilizers like manure). The main industrial fertilizer products contain nitrogen (N), phosphorus (P) and potassium (K), but many other nutrients are important as well.

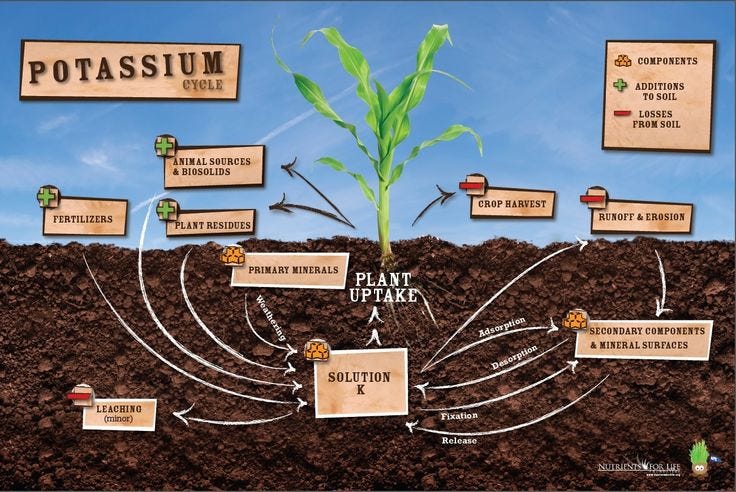

For this article, potassium is most of interest. It is important for a lot of processes in the plant including water intake, orientation of leaves towards light, activation of enzymes and the capture of CO2.

Soils usually contain large amounts of potassium, but a big proportion is not available to plants. Available potassium also get’s removed, for example when plants are harvested. This is why various mined and manufactured salts (referred to as potash) are applied as fertilizer. A very common form of Potash is KCl (potassium chloride).

While these conventional potash fertilizers indeed provide potassium to the soil, there are well known harmful effects on the soil. In particular, the salts kill microbes. Verde is solving this problem in an effective way, as we will see later.

Why is that a problem? It turns out that the soil is a very complex ecosystem. While certain microbes harm plants, may of them have win-win relationship with plants, with whom they evolved over 100’s of millions of years.

For example, they can:

promote plant growth

make nutrients available

help defend plants against diseases

increase water-holding capacity of the soil

stabilize soil PH

break down pesticides

I think it’s clear that these things matter for farmers. But the world below our feet also matters for the general public.

Let’s for consider food quality and health. Microbes can also help the plant in obtaining a variety of micronutrients. When we eat the resulting products, our bodies receive a more rich set of nutrients and we become more healthy.

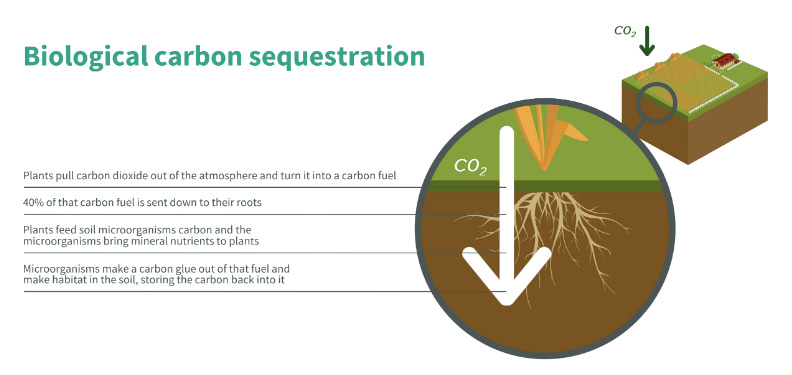

Why would these micro-organisms provide all these things to plants? An important reason is that they can get other nutrients in return. An interesting discussion of this trade-system in the ground is given in this Carbonomics presentation, that places an emphasis on the role of carbon as the “currency” of this system.

This brings me to the next big topic: the atmospheric level of CO2 and climate change. Here also these microbes have a role to play by enabling the storage of carbon in the ground. In fact, there is even talk about possible carbon credits for farmers. Carbon is also important for the fertility of the soil, without carbon credits, this process is beneficial for farmers, even without carbon credits. If you want to dive deeper in this theme, I recommend the Kiss The Ground documentary as well as this discussion with the authors.

In summary, keeping these microbes alive in the soil is a big opportunity.

Verde 1.0: disrupting chemical fertilizers

How is Verde doing this? They have a naturally occurring alternative for potash that fosters the microbes instead of killing them.

This alternative is glauconite. Glauconite is a chemically very complex mineral that contains potassium. It occurs naturally in the ground in a variety of places around the world. Verde has a very large glauconite deposit in Minais Gerais in Brazil with a very high concentration of potassium compared to other glauconite deposits. They have outlined 2.7 billion tons, enough for generations, even at very large sales volumes.

What they do with the glauconite is very simple: scoop it, ship it to the plant, crushing and grinding for mechanical activation, and then selling to farmers. There are no chemical processes involved.

While I will argue that their product may be considered a premium one, they sell it based on the potassium content. The concentration of potassium in Verdes glauconite is around 10%, while for conventional KCl, this is around 60%. So Verde prices it’s product at about 1/6th of the price of KCl (determined on international markets), on a delivered basis. I stress the delivered basis in the previous sentence, because the transportation costs are significant. This is so for conventional fertilizers, that have to be imported in Brazil, from far away (e.g. Canada, Belarus, Russia). But certainly also for Verde, since their product is less concentrated. This is why their strategy is to target (mainly) the home market in Brazil.

Brazil is an agricultural powerhouse. But it does not have a significant domestic production of potash. It imports almost al potash, ~8 million tons K2O equivalent of potash per year. This is expected to grow around around 4% until 2027. At today’s (cyclical high) prices, this market is of the order of 5-10B USD.

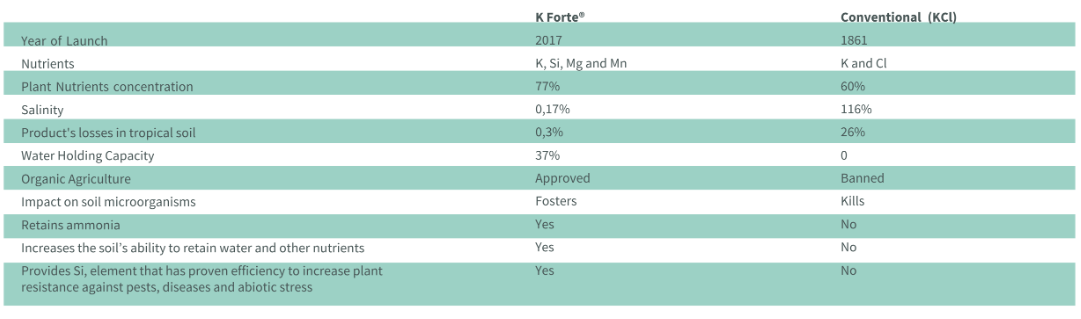

Besides the potassium content, farmers get a lot of features for free. Verde tries to make the case for this in this table:

A key feature is that it fosters rather than kills soil micro-organisms. Unsurprisingly, it is also approved for organic agriculture. Some advantages of glauconite are also described in this third-party academic paper.

There is also a disadvantage: since the potassium is less concentrated, farmers have to apply a larger volume, which presumably requires more effort and fuel. On the other hand, there are some subtleties with the release of the potassium where Verde’s product seems to be more desirable.

Are farmers buying into this value-proposition? Quite some testimonials on the Youtube channel of Verde suggest at least a part of them are. Off course, these will be cherry-picked to some extent, but I still recommend watching some of them (tip: auto-translate for language conversion). The reviews from the small amounts they sold to retail via Amazon are quite good as well.

But the most important feedback is the sales volume. The chart below shows the sales growth:

Last year, they realized a revenue of 27.7M CAD by selling 400K tons. Gross margins were 33% after adjustment for sales and product delivery (transportation) costs. The net profit was 3.5M CAD.

But the more interesting question is what the profit will be this year and the years to come.

The guidance from the company for this year is 1M tons sold, with an EBITDA of

49M CAD and a net profit 0.87 CAD/share. So at the time of writing this would correspond to a P/E (price to earnings) ratio of around 10. In Q1 they sold 112K tons with a net profit of 3M CAD. Due to yearly cyclicality (corresponding to crop planting/harvesting seasons), they will sell more in the later quarters. In fact, I believe they are likely to beat guidance. One reason for this is that their guidance has been conservative historically. In fact, this guidance is already an upwards revised guidance and something similar happened last year.

What will happen in the longer term? There are 2 key factors: sales volume and the price charged per ton (assuming the costs remain under control).

In terms of sales volume, I think there is a strong growth momentum. Guidance for next year is 2M tons sold (2x this year’s guidance). Currently they are constrained by capacity and not demand. In the beginning of July they were sold out until the end of August (see here around minute 21) and they are building out new capacity quite quickly. In fact, plant 2 should be finished during this summer, increasing yearly capacity from 600K to 3M tons. They also started the studies for an extra 10M(!) tons in capacity, which they plan to bring online in the first half of 2024 already. Since their process is so simple, the CAPEX for these expansions is quite low. In fact, they plan to return at least 10M CAD to shareholders this year while funding their growth. The 13M tons (so 13x as much as guided this year) would correspond to about 17% of the market size in Brazil, so if enough farmers like the product the market is big enough to absorb such volumes. They also sell a bit to Asia and have some discussions ongoing to export more. Such export ability would off course increase the addressable market. Due to the high export transportation cost, these parties are likely willing to pay some premium for Verdes glauconite. This suggests a growing recognition of their product.

From the potash prices, I expect some headwinds. As you can see below, the potash price has shot up in the last year to around 880 USD/ton. Since commodity prices tend to exhibit cyclical/mean-reverting dynamics, it is quite plausible that on the medium term these prices will drop.

However, Verde doesn’t need these high prices to have good margins. For example, in their guidance for this year, they seem to be quite conservative with the realized potash price. In their guidance they assume 109 CAD/ton, while their listed sales price (that you can track here) is around 260 CAD/ton. This likely won’t be the price Verde receives: they give some discounts to intermediary sellers, and (perhaps) to certain farmers to incentivize adoption. I also don’t know if some VAT has to be substracted from this price. But there is still quite some room to be higher than 109 CAD and in fact the CEO mentions “200 dollars” in this call as a sales price they quote currently. It will take time before these prices end up in the financials (due to a delay between the order and the invoice), but this is another reason why I believe they are likely to beat guidance. Nevertheless, margins will contract when the potash price will drop, but they will come from levels that are quite high and this drop will take time.

In their PFS (pre-feasibility economic study), where they contemplate some more long-term scenarios, they assume a CFR Brazil price of 368.65 USD/ton for potash. According to management this is one of the most bearish scenarios analysts are forecasting and it is certainly far below the current prices. As an example of the scenarios considered in the PFS: for a sales volume of 10M starting from 2025, they obtain an NPV of 2.91B USD or around 70 CAD/share (at an 8% discount rate). Some more expansive scenarios are considered in the PFS as well. Off course these calculations are all hypothetical. Since they can’t sell their product on an international spot market, it will largely depend on how much demand there is from farmers.

So far Verde is trying to gain market share by selling at a price comparable to potash. If they gain this market share and farmers get convinced of the benefits (as for example some farmers/consultants in testimonials seem to be), they may be able to charge a premium as certain other KCl-alternatives are. However, there is another development that may increase Verde’s margins.

Verde 2.0: Bio Revolution

In April this year, Verde announced the ability (and an approval) to mix micro-organisms with their glauconite, providing an efficient vehicle to bring micro-organism colonies into the soils. CEO Cristiano Veloso declared:

“… microorganisms are seen as a vital component in boosting plant productivity. Farmers are keenly aware of the transformational opportunities from adding microorganism to their crops, but usually encounter high-costs and technical challenges in effectively deploying microorganisms over vast areas of farmland. It was with that in mind that we developed Bio Revolution, a technology that enables our Product to become the vehicle for the direct application of microorganisms onto soils using traditional fertilization methods. This two-in-one solution will reduce costs for farmers by sustainably increasing the productivity and profitability. Given Verde’s first mover advantage, we will work to become world leaders at offering a cost-efficient platform for adding microorganisms to agriculture.”

Some of the deployment-obstacles they overcome with this are a lack of proper transportation services and a short shelf life.

The company compares this step with the transition from cell phones to smart phones. And I think this analogy makes a lot of sense. In both cases:

the one is a natural progression of the other.

the step brings a lot more options to the user. In fact, we can think about each microbe as an app.

the added functionality makes the key feature of the basic product (potentially) obsolete. Apps like Whatsapp make traditional messaging and calling somewhat obsolete, while certain microbe “apps” (potassium solubilizing bacteria like Acidothiobacillus ferrooxidans) can make more potassium available to plants making the potassium in the glauconite somewhat obsolete. And this is just potassium…

This development at Verde is not happening in a vacuum: enabled by molecular and bioinformatics advances (and perhaps an increased complex-systems awareness), the amount of research papers related to soil microorganisms has grown dramatically. So I think there is a huge potential in “apps” that may come online eventually. Verde says they are planning to add 3 more micro-organisms (after the first one, which they announced already) this year. In fact, they cited 82 microbes in their patent filing, so I think/hope many may come afterwards.

There also companies working on enhancing the fertilization abilities of microbes. Pivot Bio is such an example with nitrogen-fixing bacteria. According to this Forbes article, they reached a valuation of 2B USD last year with “tens of millions in revenue”. These companies can become a partner of Verde where they supply the microbe and Verde provides a delivery vehicle.

The first organism they will add to their glauconite is B. aryabhattai. You can find some studies of the benefits this can bring to farmers (here, here, here and here). If you dig into these, I think you will conclude that the effects of these microbes can be quite meaningful. Hence farmers may be willing to pay a meaningful sum (e.g. compared to the price of N/P/K fertilizers per ton) for these effects. The costs on the other hand could be quite low. This rumor cites 60 cents/ton as a cost price and this analysis of the “mixing process” suggests a low cost as well. I also don’t see why the company would push this development if the costs would be too high. This added value would not only increase margins with customers in Brazil but it may also make export feasible and hence increase the addressable market.

The first shipment has been applied to a property of Alysson Paolinelli, an independent director, which brings me to the topic of management. But I will first highlight some of the risks I see.

Risks

In this section I will focus on “Verde 1.0” (selling glauconite) because “Verde 2.0” is still in an early phase anyway.

There is the potash price, which I discussed above. But another risk is the political situation in Brazil in the upcoming elections. If there would be a non-peaceful transition of power in the upcoming elections, I would imagine all equities related to Brazil would be sold off, perhaps for a good reason. I don’t see the odds of this happening as very high, but it is something that I am watching.

These are some off the risks which I wanted to highlight. But as always there are more risks, including unknown ones. This is why I believe you should look into this company on your own if this write-up would intrigue you (see also the disclaimer below this article).

Management

The management deserves credit for building this company essentially from scratch while keeping dilution limited and navigating numerous challenges.

They are well aligned with shareholders. The CEO, Cristiano Veloso owns around 20% of the company. In fact, during financial hard times for the company a few years ago, management was willing to be paid in shares instead of cash. This signaled confidence to me, since these shares would be (more or less) worthless in the end if they would not succeed.

The CEO recently announced a plan to sell about 30% of his shares. It is obviously not something I like to see. But there are some mediating factors: I can understand some diversification even if he is very bullish and there are rumors that his wife is pushing for this diversification. The sale plan was also quite gradual and at considerable premiums to that day’s share price.

Lastly I would like to mention Alysson Paulinelli, an independent director of the company. He has received the World Food Prize for enabling farming in the Cerrado region in Brazil. He also has been nominated for the Nobel Peace Prize. Will the team at Verde achieve something similar one day?

Conclusion

I believe Verde Agritech at this valuation is an interesting set-up for VC-type investors, traditional value investors and ESG-investors. I think a lot of trends ranging from carbon credits to resource nationalism and supply-chain disruptions are in their favor. But most importantly, I think they have a superior product in a sizeable market. The four main variables I will be watching will be

sales volume growth (enabled by capacity expansion and demand)

the price trajectory of potash

the build-out of the Bio Revolution “app store”

and it’s adoption by farmers.

I believe vis-a-vis the significance of the story, the company is quite under-the-radar (hence why I write about it). This may change soon, since they are in the process of uplisting to the NYSE or NASDAQ. Ultimately, I don’t know how this will play out, but I am certainly watching with great intensity, and eager to update you on how this turns out.

If you feel like people in your (social) network may be interested in this company, please share this post.

Disclaimer: I am long Verde Agritech. Consider me biased. This is for educational and entertainment purposes only and should not be construed as financial advice. Please do your own due diligence and/or consult a financial advisor. With regards to the factual correctness of this article: I try very hard to be correct and cite sources where you can look for yourself, but it is always possible I have made a mistake somewhere. Please let me know when you spot one.

Great writeup, thanks for sharing! I am long since 2018 when I first heard about it on the MicrocapClub and built a starter position. It was one of those "hard not to own at least a little" company. Now it's grown into my biggest position and biggest gain ever and I added 15k shares close to 6$ on the pullback.

Would you mind if I translate your writeup to a french microcap forum (espacemc dot com) and of course provide a link to your substack for those who can read english?

Very interesting, but where is the moat in this? If it's cost-effective then why won't a lot of other companies start doing it? Without a moat there is no real first-mover advantage.