Will Graphene Manufacturing Group become an industrial (battery) giant?

Wonder material graphene is starting to get mature. GMG doesn't only have a new technology to produce it cheaply at scale, they may turn the battery market on it's head with it.

Overview

GMG is pioneering a new production process for high-quality graphene that has led to the development of several disruptive products.

Their graphene-aluminum ion batteries may disrupt the battery industry.

They are commercializing a coating that saves energy for HVAC systems.

Management has impressive CVs, including experience with big projects.

Feel free to subscribe here. I would really appreciate it and as always thanks for reading!

Share Structure

Let’s start with an overview of the share structure of Graphene Manufacturing Group.

Ticker: GMG.V (Venture exchange in Canada)

# shares outstanding:~78M (as of 31/3/2022)

# warrants and options:~8.3M

Undiluted market cap @3.34 CAD/share:~261M CAD (~208M USD)

Insider ownership:~35%

Cash:~14M CAD (30/9/2021)

Graphene

How can we understand a company called “Graphene Manufacturing Group” without introducing graphene?

Graphene has for years been viewed as a “wonder material” due to it’s unique properties. Critics have called it a wonder-how-to-use material, because production at scale and full utilization of the benefits in practice has been elusive so far.

Physically, it is a 2D-arrangement of carbon atoms that looks like this:

It has unique properties, the most relevant ones for this post are: extreme thermal conductivity and enhanced lubrication and ion-storage. While “real” graphene is a 2D material, in practice, it tends to be produced with a few or more layers. If there are very many layers of graphene stacked on top of each other, the material is called graphite. Also, in reality, not all the atoms, are carbon. There are some other atoms as well, so the graphene won’t be perfectly pure. In fact, instead of talking about “graphene”, we should talk about “a graphene”, since different graphenes have different properties like the amount of impurities and the size. This is important, because the properties of the particular graphene, have a big effect on the products that are created from it.

GMGs graphene production process

Producing graphene at scale so far has been a challenge. Some companies are making progress, but there are some hurdles, most notably quality, price and scalability. Furthermore, several approaches require mined graphite as an input.

GMG is pioneering a new way to produce graphene, converting natural gas directly (via an electric plasma) into graphene and hydrogen.

The process is (said to be) scalable, using only natural gas (no graphite), which is cheaply available and abundant. Their process is also tweakable to customer specifications, and allows for a high purity.

The business model

The fact they found a production process with all these advantages, would make you think the business model is to exploit this process and sell a (high-quality) graphene, right? They do a tiny bit of that, but the vision of management is much bigger. Using graphene, while it may supercharge the product, is not straightforward and customers asked them a lot of questions on how to use it. So they decided to make value-added products from the graphene themselves. They claim they tested their (high-quality) graphene for more than 200 applications and focused on the select best opportunities: the ones where their particular graphene shined the most, and solved the biggest problem. These are the three main products/markets they are focusing on:

Let’s start with the one that presents a potential blue sky opportunity: batteries. The market for this is huge: around 100B USD and growing around 14% yearly, being at the center of a long-term electrification trend. While GMG is experimenting with different technologies, their graphene-aluminium ion technology seems so far the most promising, very promising actually…

Next-generation (graphene-aluminum) batteries

The specifications the company has provided for these batteries are impressive. And there is (a lot of) room for optimization beyond this since their technology is still very new.

The most striking property of their batteries is the power density. This determines how fast the battery can be charged or discharged. The power density of GMGs batteries is 7,000W/kg, more than 20 times as much as the current Li-ion technology! This may be a game-changer. For example, cell phones could be charged in a few minutes or less. EVs would recharge much quicker. It may also enable new technologies, let’s think for example about air-planes that have to be able to takeoff. Perhaps GMG’s batteries enable electric aviation in 10 years?

Their batteries require a different way of charging (due to the high power-density). For personal electronics, a thicker cable (which is very manageable) should be enough. For electric vehicles, probably another system is required. It’s probable that this infrastructure will arise in the next years, but GMG will first target personal electronics anyway.

Another important specification of batteries, is the energy density. This is the factor most talked about when battery technologies targeted at EVs are discussed. This is because the energy density determines how far a car with a certain battery weight or volume can drive without recharging. Interrupting your drive to having to charge for hours is obviously pretty annoying. The same holds for other applications. GMGs energy density is around 150W/kg, compared to 100-265W/kg for the conventional technology. It is important to keep in mind here that GMG has (possibly a lot of) room here for further optimization. However, competitors are working on higher energy density compared to the current technology. For example QuantumScape, one of the leaders in the Solid State battery technology has around 1000 W/kg as a specification for their energy density.

In brief, in terms of power density, GMGs batteries are truly at another level. For energy density it’s certainly possible or even plausible that competitors will win. But energy density also doesn’t look like a deal-breaker to me. In fact, the extremely quick charging would make the energy density a lot less important for a lot of applications. When you drive to your holiday destination, you will anyway stretch your legs or drink a coffee, right? If during a coffee your car is fully charged, you also don’t have to wait and the “range problem” is also solved.

When I encountered this company, I was excited at this point already, but there are further benefits of their technology. They have no significant fire risk, while the current technology does, look for example at this article:

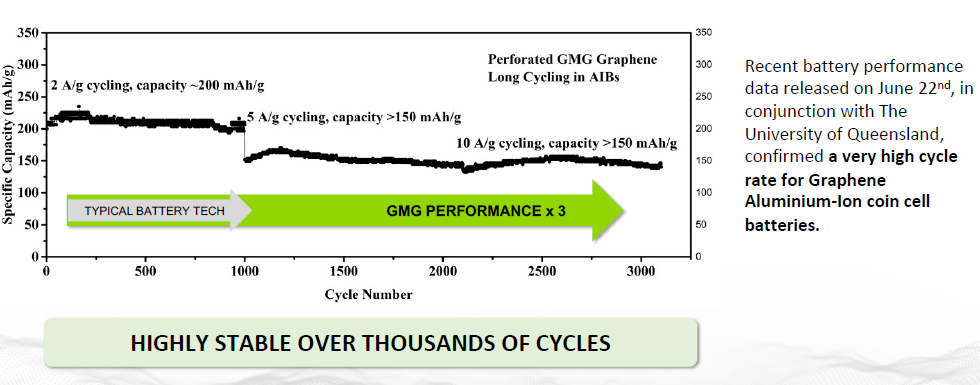

Their batteries are also extremely long-lasting, lasting for thousands of cycles, which is very good compared to the competition.

Another major advantage is that it doesn’t require cobalt, nickel, lithium and other battery metals, only aluminum (or graphene that they don’t produce themselves) and natural gas. This is important for the cost of producing a battery, but also for the total capacity of batteries that can be brought in the market. In fact there are many projections about battery metal shortages in the future. Shortages in available materials may put a (temporary or not-so-temporary) ceiling on the amount of batteries that can be produced using battery-metal-requiring technologies and cause a big push towards GMGs technology (or other alternatives).

The figure below illustrates the huge increases in metal production that will be required to meet demand. According to these projections, nickel will have to double, cobalt quadruple, and lithium multiply by a factor of 36…

The prices for these metals have been increasing lately as well, with Lithium as a good example:

Besides the price, there are ethical questions that can be had with the mining of some of the battery metals. For example, cobalt mining can involve child labor in Congo.

Taking everything together, I think they have a real shot at becoming (a piece of) the next-generation of batteries. In this overview, the author provided overview of the specifications of the technology by GMG and Quantumscape, as well as the current Lithium-ion technology and was so friendly to let me use the summary table below (it could be slightly inaccurate or outdated but gives a rough idea). I highly recommend reading the original article for more context and background, but the author was so friendly to let me use his overview:

In my mind, the specifications are not only favorable compared to the current technology, but also compared to QuantumScape, which has a valuation that is more than 20 times higher …

In a news release from a year ago, the company states:

“More than 80 incoming requests from across the globe have been received by the Company from organizations seeking to explore potential applications in electric consumer vehicles, high-performance cars, heavy duty vehicles, motor bikes, air transport, personal appliances such as laptop computers and phones, grid-connected storage, and others. Several parties noted, among other things, the potential high power density of graphene aluminium-ion batteries which enables faster-charging; that graphene aluminium-ion batteries are expected to be greener and be able to be produced without lithium and rare earths; that the performance of such batteries are expected to be safer, with much lower fire risk; and finally that graphene aluminium-ion batteries are expected not to require the complexity and weight of cooling systems required by lithium-ion battery technology.”

Since then, many more companies have contacted them. Another juicy is quote is that they are “engaging some very large companies, who quite frankly are amongst the biggest buyers of batteries in the world”.

So the battery specifics that the company seem to be excellent and attracting a lot of interest. But will they be able to produce and sell them (at scale)?

GMG recognizes that it is challenging (if not impossible) for a small company to bring these batteries quickly to the market, at scale. This is why they are building a “coalition of the willing” : a coalition of (big) partners that helps them to bring this battery in the market quickly and at scale. The figure below illustrates the value chain and the partners they have currently.

The most eye-catching partnerships are with industrial giant Bosch and mining giant

Rio Tinto. Both agreements are non-binding, but I assume these big companies don’t let start-ups connect their name to them on a whim…

The agreement with Bosch involves Bosch designing and delivering a manufacturing plant for their batteries. The agreement with Rio Tinto has multiple angles

The biggest gap in the value chain, is an end customer agreeing to buy the batteries.

GMG has sent prototypes to customers. These prototypes are “coin cells” that can be used for personal electronics (not EVs for example). The potential customers are now evaluating the batteries. Preliminary feedback described in the latest Management Discussion and Analysis is good and in line with the specifications described above.

Now I think the market is waiting for the best form of feedback which is a sales contract. Let’s watch…

Thermal XR

Besides the batteries, GMG is focusing on a coating which results in energy-savings for HVAC systems and on graphene-enhancements of lubricants.

I will briefly discuss the first product, since it is the closest to material revenue. The commercial name is Thermal XR. It is a coating that when applied to HVAC systems levers the extreme thermal conductivity of GMGs graphene to make the heat exchange more effective and in this way save energy. GMG has run a number of studies on the energy-savings. 5% seems to be a conservative estimate. Considering around 10% of global electricity is used in such systems, the potential reductions can have a significant economic and ecologic value.

This product is the closest to commercial revenue, which may come from application to existing systems , in the Middle-East via their partnership with Openia, or from a deal with original equipment manufacturers.

Management

Management seems to be top-notch, considering they are (still) a microcap. For example, CEO Craig Nicol and others worked at oil giant Shell before in a high-profile function, managing big (think billion $) projects. I believe management of a start-up is very important, hence I recommend reading this page explaining the background of the different people, as well as the most recent additions.

Outlook

This is what the company says are the 4 key objectives for the remainder of this year. The most important thing I am looking for commercial revenue for Thermal XR or a sales contract for the batteries.

Conclusion

GMG is at the intersection of three mega-trends: the green revolution/electrification (a trend that will only be accelerate by the war in Ukraine), the commercialization of the benefits of graphene, and the commodity (and energy) shortage.

They have multiple shots on goal. If the Thermal XR division succeeds at marketing the product well and capturing a piece of the market and protecting this market share, this alone would make GMG a very good investment in my view.

The batteries are the blue sky: if they can capture a part of that market at decent market without diluting the current shareholders too much, I think the sky is the limit.

But off course, so far, in terms of revenue (let alone profit) the company doesn’t have any significance yet, so this is certainly a (very) high-risk stock. Make sure to also read the disclaimer at the end of this article.

I would like to thank Sven Vande Broek for valuable feedback and constructive advice in writing this.

There are many more angles on GMG that I want to cover more in-depth in the future, as well as other companies that have like GMG a very interesting disruptive value-proposition. If you have questions, please post them in the comments.

If you sign up here, you will receive the result of my research straight into your mailbox.

Disclaimer: I am long GMG.V, consider me biased and do your own due diligence. This not financial advice, and an investment in GMG could result in losing all your invested money. While I try hard to rely on good sources and be factual, it is conceivable that the article contains inaccuracies or false statements.

Nice write up. Thank you.